When is my Scottish Child Payment calculated from?

If eligible, Scottish Child Payment is calculated from the date on your application.

Depending on your payment cycle you may receive a part payment initially before starting to receive £100 per eligible child every 4 weeks.

As payments are made in arrears, your payment may continue for a month or two after your child turns 16.

I received Scottish Child Payment on December 23. When will my next payment be?

Many people were paid early due to the 2022 Christmas holidays.

Payments have now returned to their normal cycle.

If you received an early payment last month, it means that it may be more than 4 weeks between that and the following payment.

I already receive Scottish Child Payment and my children are all under 6. Do I need to make a new application?

No, you don’t need to do anything. You will receive Scottish Child Payment at the new rate of £25 per child per week automatically from 14 November.

I have been receiving Scottish Child Payment but my child turns 6 before 14 November. Do I need to reapply?

Yes. You should make a new application on 14 November.

I receive Scottish Child Payment for my child aged under 6. But I also have a child aged 6 or over. What should I do?

You can add older children to your existing award through the online Scottish Child Payment form. There’s no need to do a completely new application.

I am working. Does that mean I won’t qualify?

No, a significant proportion of people who receive qualifying benefits such as Universal Credit are in work. So long as you are in receipt of a qualifying benefit you can still be eligible for Scottish Child Payment.

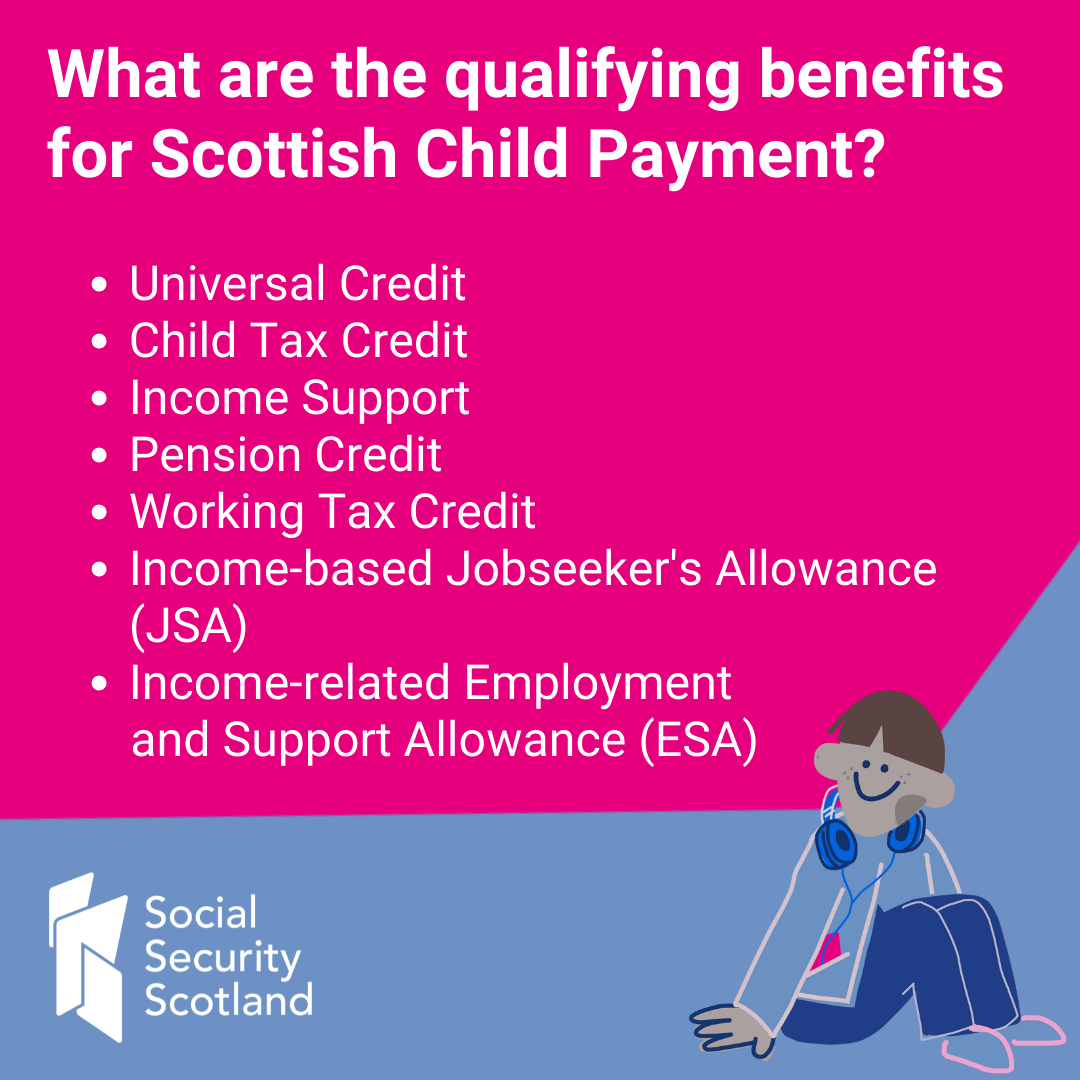

What are the qualifying benefits for Scottish Child Payment?

- Universal Credit

- Income Support

- Pension Credit

- Income-based Jobseeker's Allowance (JSA)

- Income-related Employment and Support Allowance (ESA)

I am a kinship carer, can I qualify for Scottish Child Payment?

People who care for children in their family but who aren’t their parents – known as kinship carers – can qualify for Scottish Child Payment if they meet the eligibility criteria.

If I receive Scottish Child Payment, will it affect my tax payments or other benefits?

No. If you receive Scottish Child Payment, it will not affect this.

I get Bridging Payments. Will I need to apply for Scottish Child Payment?

Yes. Bridging Payments are administered completely separately to Scottish Child Payment. So, if you are eligible for Scottish Child Payment, you should apply for it in the normal way regardless of whether you get Bridging Payments. You will still get your final Bridging Payment (of £260) in December.